QUESTION

Once

a consumer locks his or her interest rate, are there any waiting period

requirements prior to closing?

ANSWER

In

certain instances, a lender will not be able to close a mortgage loan

immediately following a consumer locking the rate. Waiting period requirements exist in some

instances depending on the circumstances as well as the state in which the

subject property is located.

There

are many considerations to take into account when determining whether a waiting

period exists between rate lock and closing.

First,

a mortgage lender must consider whether the seven business day waiting period

from initial disclosures expired. A creditor must deliver or mail initial

disclosures no later than three business days after receiving the consumer’s

application and at least seven business days before consummation.

If

this requirement has been met, a mortgage lender must next consider whether the

rate lock resulted in any changes in terms requiring re-disclosure of the Truth-in-Lending

Statement (“TIL”) due to inaccuracy of the annual percentage rate (“APR”). The

APR is inaccurate if the APR varies by more than one-eighth of one percent

(.125) in a regular transaction or more than one quarter of one percent (.25)

in an irregular transaction; and, if either inaccuracy occurs, a revised TIL

must be re-disclosed. Irregular transactions include transactions with multiple

advances, irregular payment periods, or amounts other than an irregular first

or last period or payment. If the APR is inaccurate and re-disclosure is

required, the mortgage loan transaction cannot close until three business days

after the consumer receives the revised TIL.

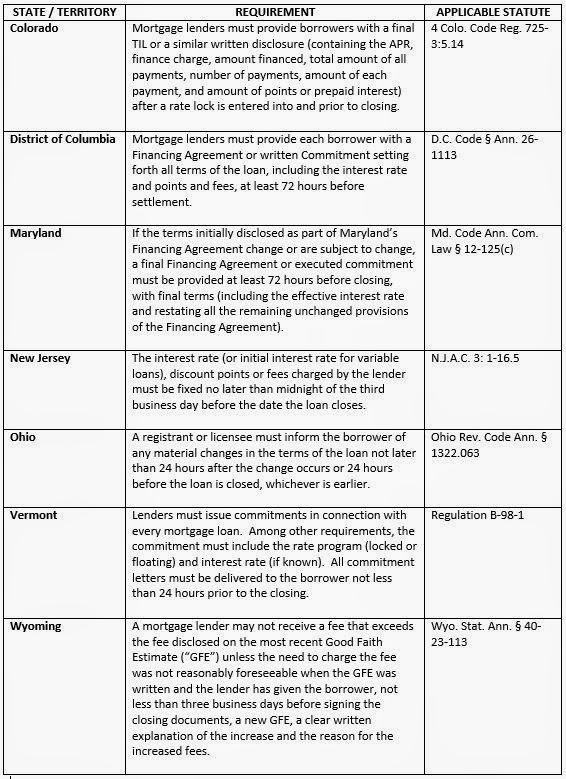

In

addition to the above waiting periods, various states impose additional waiting

periods between rate lock and closing. Currently, the following states require

a waiting period between rate lock and closing in certain instances:

There

are several factors to take into account once a consumer locks his or her

interest rate and prior to closing the loan. Lenders must be cautious when

determining if a waiting period exists. Waiving a waiting period for a bona fide emergency or other reason

should likely only occur in rare instances and must be properly evaluated and

documented.

Michael

Barone

Director/Legal

& Regulatory Compliance

Lenders Compliance Group