QUESTION

Is it true that a creditor cannot itemize recording fees and other government

fees and taxes on the Closing Disclosure (“CD”)? If so, how does a creditor

reflect such fees and taxes on the CD?

ANSWER

Yes, it is true! The TILA-RESPA Integrated Disclosure Rule (“TRID”)

does not permit the itemization of recording fees and other government fees and

taxes on the CD. Instead, TRID requires

that all recording fees and government fees and taxes, other than transfer

taxes, be added together and listed as a lump sum on the CD. [§

1026.37(g)(1)(i)]

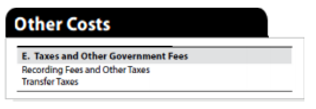

The lump sum total must be recorded in Section E of the CD as “Recording

Fees and Other Taxes” under the “Taxes and Other Government Fees” subheading. [Idem]

Additionally, all transfer taxes must be totaled and recorded as a lump

sum on the next line.

[§ 1026.37(g)(1)(ii)].

See below:

Moreover, TRID does not permit additional lines or items to be added to

individually catalogue these fees and taxes. [Commentary at 1026.37(g)(1)-6] If

no recording fees or transfer taxes are charged, these lines should simply be

left blank. Lines from this section should never be deleted. [Idem]

In the event a creditor desires to itemize and disclose these fees and

taxes, or state law requires such disclosure, we suggest the creditor do so

using a separate document. To meet this need, the American Land Title

Association (“ALTA”) has developed the ALTA Settlement Statement (http://www.alta.org/cfpb/documents.cfm),

which provides a model form for disclosure of all itemized fees and charges

that buyers and sellers pay during the settlement process.

Michael Barone

Executive Director

Director/Legal & Regulatory Compliance

Lenders Compliance Group